colorado electric vehicle tax rebate

Drive Electric Colorado Top 5 Reasons to Drive an EV in Colorado 2500 tax incentive on ALL new EVs in Colorado in addition to the Federal tax credit available on many models. Its a compact utility vehicle with 238 miles of range and a starting price of 37500 before incentives.

Tax Credits Drive Electric Colorado

As of 2021 Colorado offers a vehicle-related incentive for new EVs light passenger vehicles up to 2500.

. Your local utility may offer rebates for the purchase of a new EV or the installation of a residential Level 2 charger. Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. For colorados 5000 tax credit that means the incentive likely improved sales by 265.

In addition to the Colorado-specific incentives offered by the State there are a number of federal tax credits for fuel-efficient vehicle owners. Electric vehicles emit fewer greenhouse gases than gas-powered vehicles. How much can I save with the Colorado electric vehicle incentive.

Sales and Use Tax Exemption for Renewable Energy Equipment. Local Option - Sales and Use Tax Exemption for Renewable Energy Systems. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan.

717-712-3742 Delta Eagle Garfield Gunnison Hinsdale Moffat Lake Mesa Montrose Ouray Pitkin Rio Blanco Routt Summit Drive Clean Colorado DCC- Denver Metro ReCharge Coach. Check below to learn more about what your utility offers. Why buy an Electric Vehicle.

Some dealers offer this at point of sale. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. Eligible customers who purchase and install evse can receive a rebate of 70 of the cost of the evse up to 500.

Electric Vehicle EV Tax Credit Qualified EVs titled and registered in Colorado are eligible for a tax credit. The Colorado EV rebate tiers are as follows for January 1 2021 through January 1 2023. City of Boulder - Solar Sales and Use Tax Rebate.

Light-duty EVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year. Grants are available for EVs and community-based Level 2 and Level 3 charging stations. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle.

You can charge at home. To qualify Xcel customers must be enrolled in specific government. The credits decrease every few years from 2500 during January 2021 2023 to 2000 from 2023-2026.

So weve got 5500 off a new EV purchase or lease and 3000 off of used. For tax years January 1 2010 January 1. Trucks are eligible for a higher incentive.

The Chevrolet Bolt EV. No more standing in the wind or snow waiting at the gas pump. For additional information consult a dealership or this legislative council staff issue brief.

Feel good about driving a car that is friendlier to the environment than your old car. An income tax credit is available for 50 of the cost of alternative fueling infrastructure up to 5000. Colorado electric vehicle tax rebate Sunday March 20 2022 Please contact the store by email or phone for details and availability of incentives.

Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. Some of them may expire by the end of the year so take a look at what you may be eligible for and make the most of these incentives and credits. Colorado electric vehicle tax credit.

There is also a federal tax credit available up to 7500 depending on the cars battery capacity. The Chevy Bolt EV is GMs first long-range all-electric vehicle. A 5500 rebate on a new electric car and a 3000 rebate on a pre-owned car so long as the price tag does not exceed 50000.

Tax credits for conversations are available until January 1 2022. Dont miss out on these deals. Only utilities with active EV purchase and EV charger programs are listed below.

Lgiuq9ilmzfcfm Residency restrictions may apply. For additional information consult a dealership or this Legislative Council Staff Issue Brief. Tax credits for conversations are available until January 1 2022.

Colorado Energy Offices Recharge Colorado program works to advance the adoption of electric vehicles EVs and charging installations throughout. Dubbed Innovative Motor Vehicle and Truck Credits for Electric and Plug-in Hybrid Electric Vehicles the program provides fully refundable tax credits for qualified vehicles purchased from January 1 2021 to January 1 2026. You may also qualify for additional Utilities Rebates Incentives if your local utility provider offers EV purchase and EV charger programs.

Alternative Fueling Infrastructure Tax Credit. The credit is worth up to 5000 for passenger vehicles and more for trucks. The Colorado Energy Office CEO and Regional Air Quality Council RAQC jointly administer the Charge Ahead Colorado electric vehicle EV charging infrastructure grant program.

1500 between 2021 to 2026. 2500 in state tax credits and up to 7500 in federal tax credits. You might qualify for tax credits offered by the IRS if you purchase.

Electric Vehicle EV Tax Credit Qualified EVs titled and registered in Colorado are eligible for a tax credit.

Ev Myths And Myth Busters Drive Electric Colorado

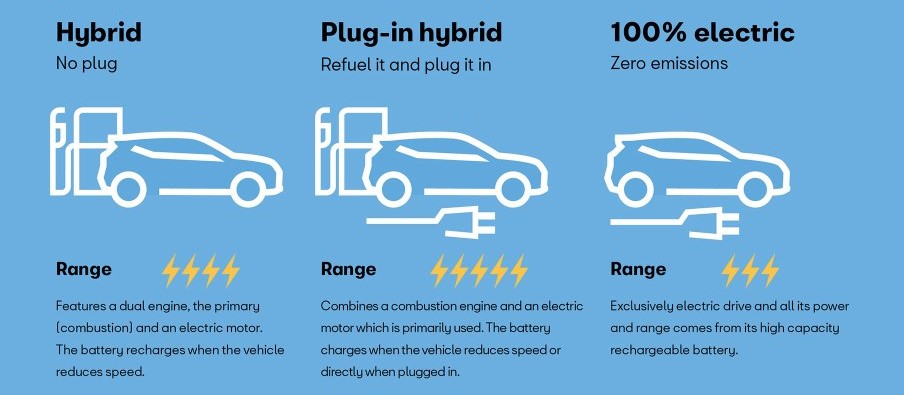

All About Electric Vehicles Drive Electric Colorado

Top 9 Cheapest Electric Cars To Buy Autoguide Com News

/cloudfront-us-east-2.images.arcpublishing.com/reuters/43L4KKPDZFPS7AEGULKUZGRNT4.jpg)

Ustr Backs Efforts To Strengthen U S Ev Industry Despite Objections Reuters

Joseph Biden Aims To Improve Us Ev Tax Credit Restore It For Tesla Gm Electric Cars Tesla Fuel Cost

The True Cost Of Going Electric Gobankingrates

How Do Electric Car Tax Credits Work Credit Karma

Get A New Nissan Leaf As Low As 11 510 After Incentives In Kansas Or Missouri Nissan Leaf Nissan Best Hybrid Cars

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

How To Claim An Electric Vehicle Tax Credit Enel X

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credits What You Need To Know Edmunds

/cdn.vox-cdn.com/uploads/chorus_asset/file/22633236/1232464562.jpg)

The Fastest Way To Get More People To Buy Electric Vehicles Build More Charging Stations Vox