social security tax limit 2021

9 rows Maximum Taxable Earnings. If you earn 142800 per year in 2021 the maximum youll pay in Social Security taxes is 62 of your income or 885360 per year.

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

We guide you step by step with simple plain-English questions and apply the appropriate tax laws in the background.

. Read More at AARP. Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. Other important 2021 Social Security information is as follows.

The wage base limit is the maximum wage thats subject to the tax for that year. Hence the maximum amount of the employers Social Security tax for each employee in 2021 is 885360 62 X 142800. Only the social security tax has a wage base limit.

This amount is known as the maximum taxable earnings and changes each year. The income limit for 2021 is 147700 so anything you earn above this limit wont be taxed for Social Security purposes. B One-half of amount on line A.

Nobody Pays Taxes on More Than 85 of Their Social Security Benefits. The Social Security tax limit in 2021 is 885360. D Tax-exempt interest plus any exclusions from income.

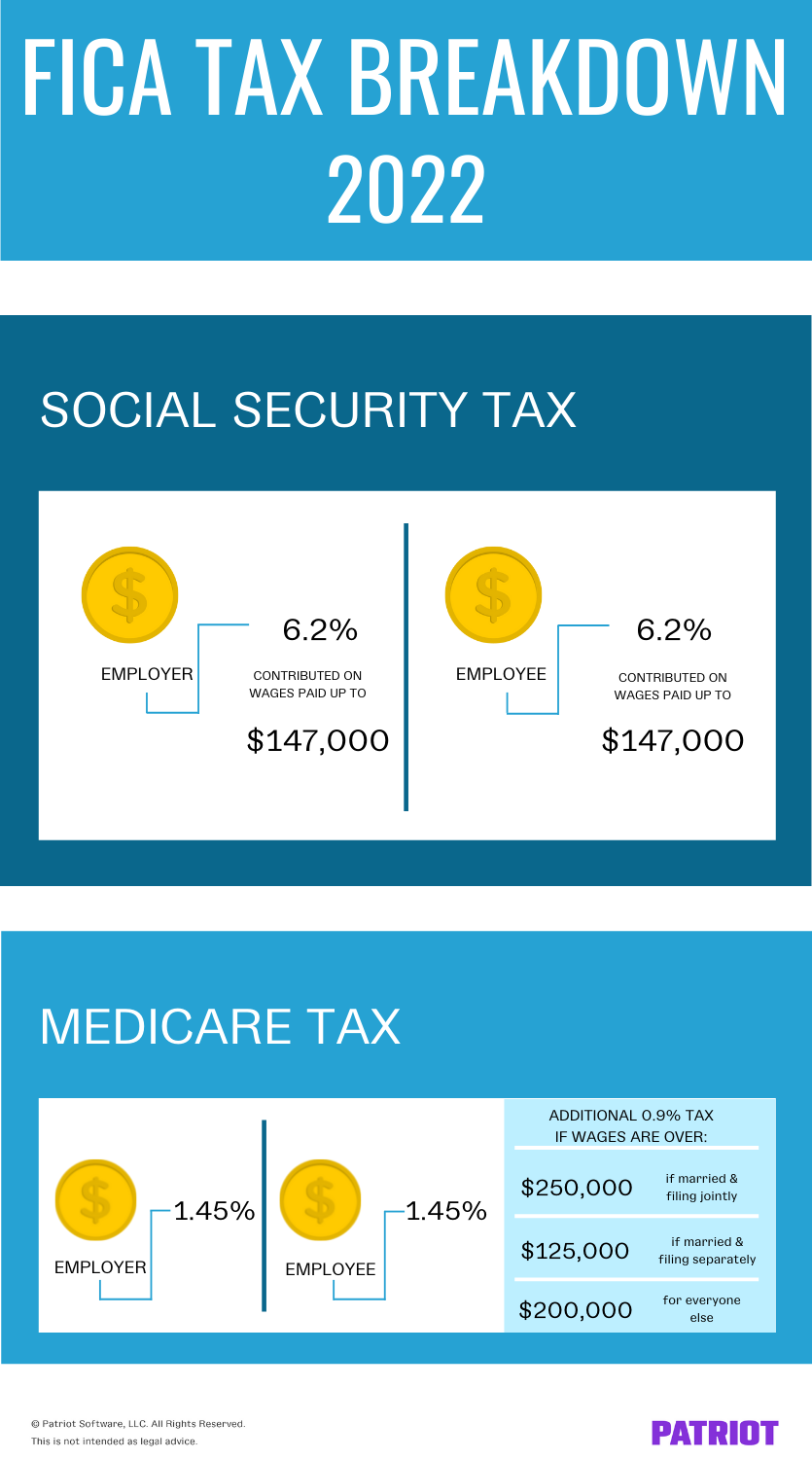

In your situation your provisional income is at a level that the maximum 85 of your Social Security benefits amounting to 26070 will be subject to federal income tax for 2021 he said. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022. If you file as an individual with a total income thats less than 25000 you wont have to pay taxes on your Social Security benefits in 2021 according to the Social Security Administration.

Hospital Insurance HI also called Medicare Part ANo limit Federal Tax Rate. Max OASDI Max HI. If you are working there is a limit on the amount of your earnings that is taxed by Social Security.

Workers pay a 62 Social Security tax on their earnings until they reach 142800 in earnings for the year. They dont include supplemental security income payments which arent taxable. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus.

For earnings in 2022 this base is 147000. Or Publication 51 for agricultural employers. The maximum amount of Social Security tax an employee will have withheld from their paycheck in 2022 will be 9114.

Refer to Whats New in Publication 15 for the current wage limit for social security wages. Exceed 142800 the amount in excess of 142800 is not subject to the Social Security tax. Answer Simple Questions About Your Life And We Do The Rest.

The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. For the 2021 tax year single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security benefits. Ad File 1040ez Free today for a faster refund.

Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. We call this annual limit the contribution and benefit base. This amount is also commonly referred to as the taxable maximum.

Employers Social Security Payroll Tax for 2022. The maximum earnings that are taxed have changed over the years as shown in the chart below. Online tax filing is developed with do-it-yourself filers in mind.

Worksheet to Determine if Benefits May Be Taxable. The number of credits you need to be eligible for Social Security benefits depends on your age and the type of benefit for which you are applying. The OASDI tax rate for wages paid in 2022 is set by statute at 62 percent for employees and employers each.

For earnings in 2022 this base is 147000. C Taxable pensions wages interest dividends and other. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must pay income taxes on up to 50 of their Social Security.

Social Security benefits include monthly retirement survivor and disability benefits. 145 Medicare tax on the first 200000 of wages 250000 for joint returns. This means that you will not be required to pay any additional Social Security taxes beyond this amount.

For 2021 an employee will pay. You can earn a maximum of four credits each year. File With Confidence Today.

Tax Rate 2020 2021 Employee. Most people need 40 credits to qualify for retirement benefits. Ad From Simple To Complex Taxes Filing With TurboTax Is Easy.

Thus an individual with wages equal to or larger than 147000 would contribute 911400 to the OASDI. In 2022 the Social Security tax limit is 147000 up from 142800 in 2021. If an employees 2021 wages salaries etc.

IRS Tax Tip 2021-66 May 12 2021. The Social Security taxable maximum is 142800 in 2021. Social Security Program Old Age Survivors and Disability Insurance OASDI 2021 Maximum Taxable Earnings.

A Amount of Social Security or Railroad Retirement Benefits. Wage Base Limits. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits.

125000 for married taxpayers filing a. Medicare taxes are also collected at a rate of 145 for both employee and employer. When you work you earn credits toward Social Security benefits.

File Your Taxes Online and Get The Most Deductions. If your combined income was more than 34000 you will pay taxes on up to 85 of your Social Security benefits.

What Are Social Security Wages What Is Social Social Security Security

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Did You Know Even As Your Social Security Tax Has A Limit There Is No Limit To The Amount Of Medicare Taxes If Y Tax Help Business Goals Profitable Business

Fica Tax Guide 2021 Payroll Tax Rates Definition Smartasset

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

What Is Social Security Tax Calculations Reporting More

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Is The Social Security Tax Limit Social Security Us News

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

Download Our Free 2021 Tfsa Ebook Both The Tfsa And Rrsp Are Awesome Savings Vehicles Here S How The Two Accounts Stack In Ter In 2021 Stock Market Free Accounting

Social Security Tax Cap In 2021 Staircase Lighting Paint Drop Staircase

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

The 3 Most Surprising Social Security Benefits You Can Get The Motley Fool In 2021 The Motley Fool The Fool Investing

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Social Security Wage Base Increases To 142 800 For 2021

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Finance Ministry Defends Epf S Tax Free Thresholds In 2021 Tax Free Finance Business Advisor